Stamp Duty Cash Payment In Sale

Stamp Duty on Cash Payments on Sales Invoices Odoo App allows users to create and manage stamp duty on invoices. Users can set tax rates, select a stamp duty chart of accounts, create payment methods, and set up configured stamp duty. When creating an invoice, users can choose a payment method. Stamp duty is also calculated on this basis and included in the total amount. Users can view stamp duty in PDF invoice reports.

Features

1) Manage Stamp Duty Tax

User easily create and manage stamp duty tax in invoice.

2) Set Tax Percentage in Stamp Duty

User can set the tax percentage(%) in created stamp duty.

3) Select Payment Method in an Invoice

User select payment method and based on that stamp duty will be calculated in an invoice.

4) Stamp Duty in an Invoice Report

User can see stamp duty will be printed in an invoice PDF report.

Also read: Salesperson Wise Invoice Payment Report

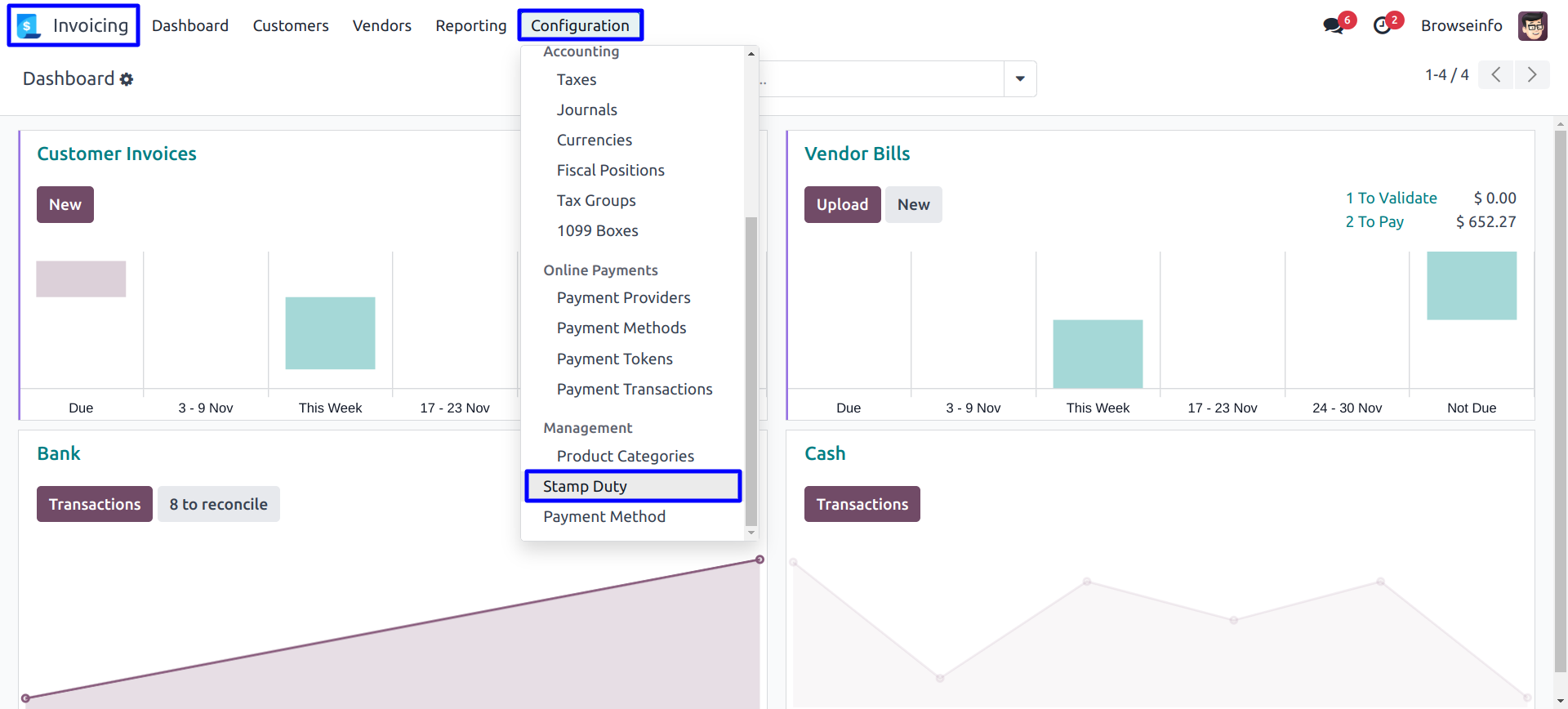

Stamp Duty Menu

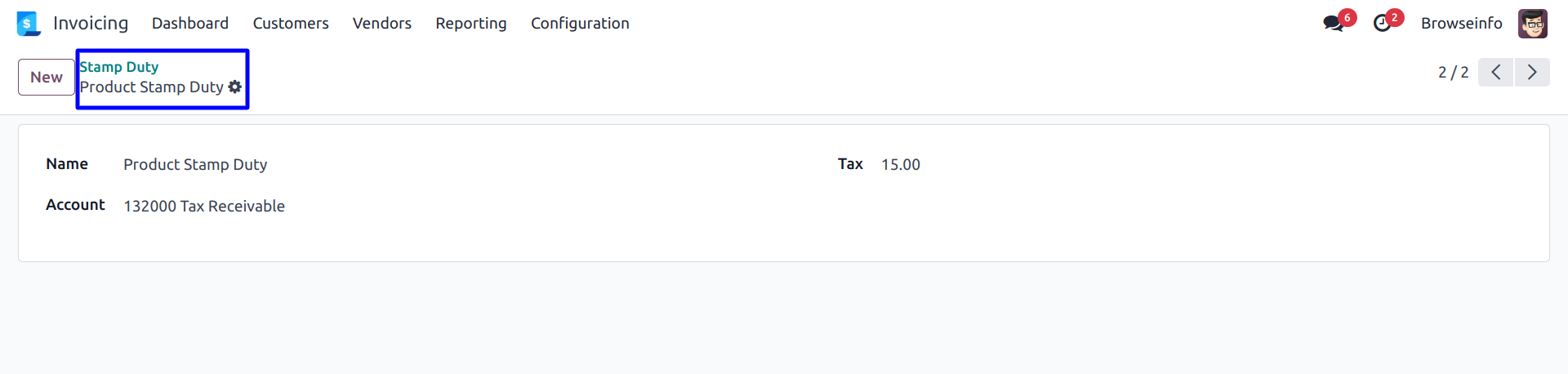

Under Invoicing -> Configuration -> Stamp Duty Menu in that user can create a stamp duty.

User can create a stamp duty with set percentage of tax and select the chart of account.

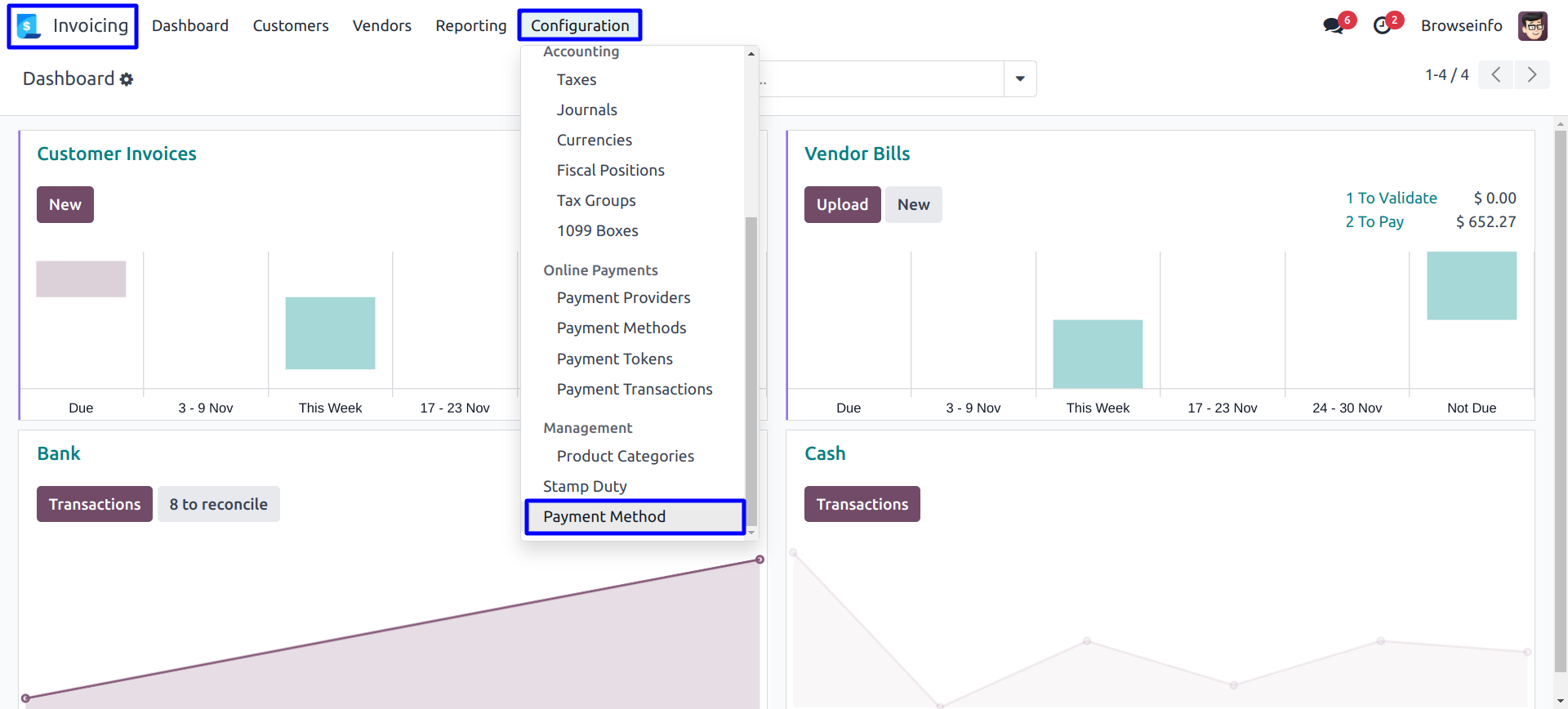

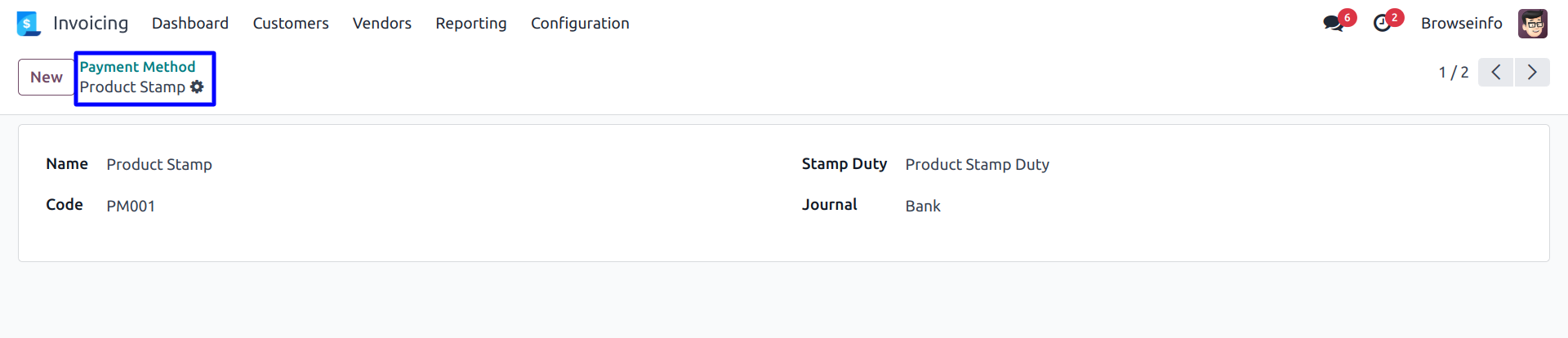

Payment Method Menu

Under Invoicing -> Configuration -> Payment Method Menu in that user can create a payment method.

User can create a payment method with set code and selection of stamp duty and journal.

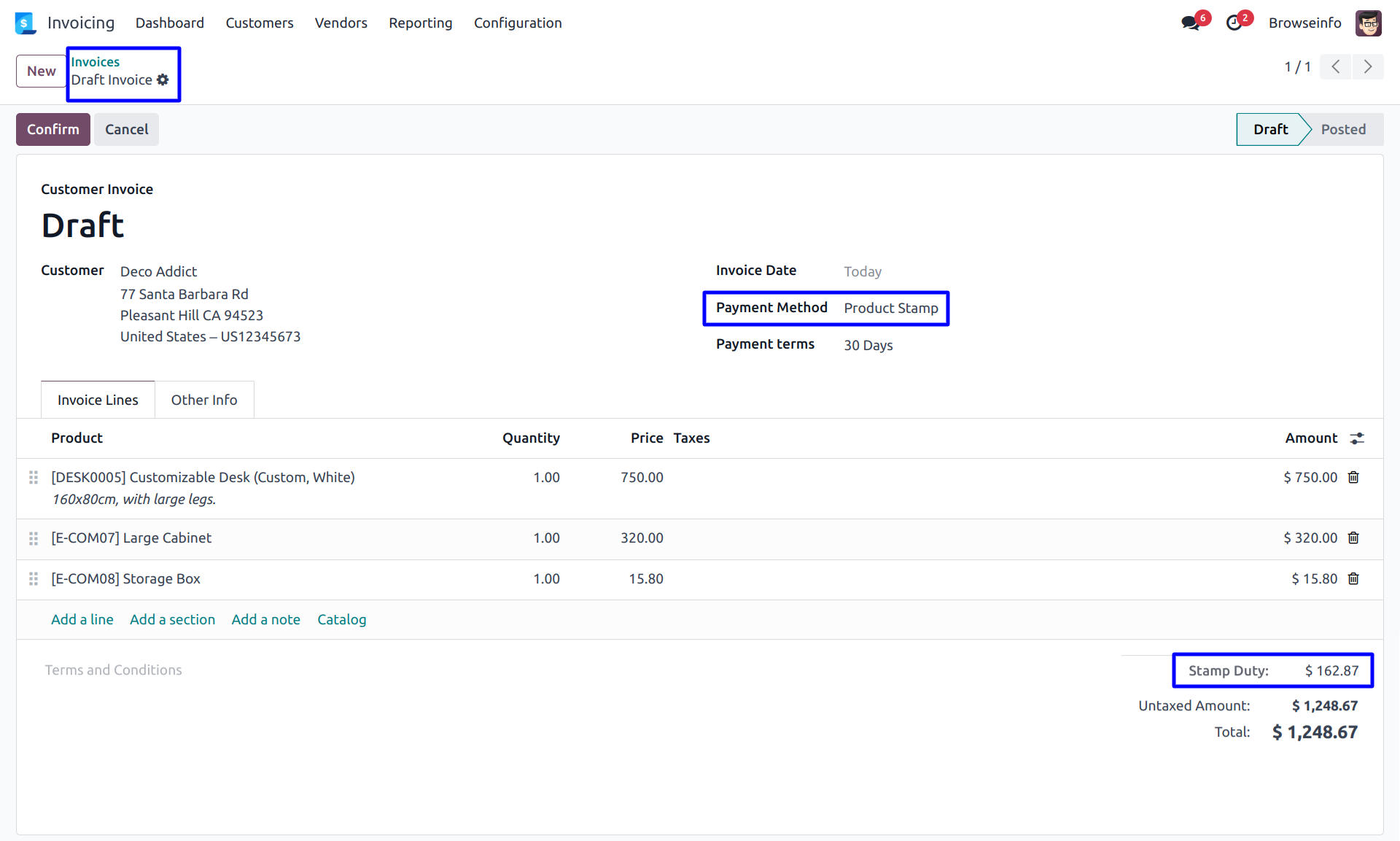

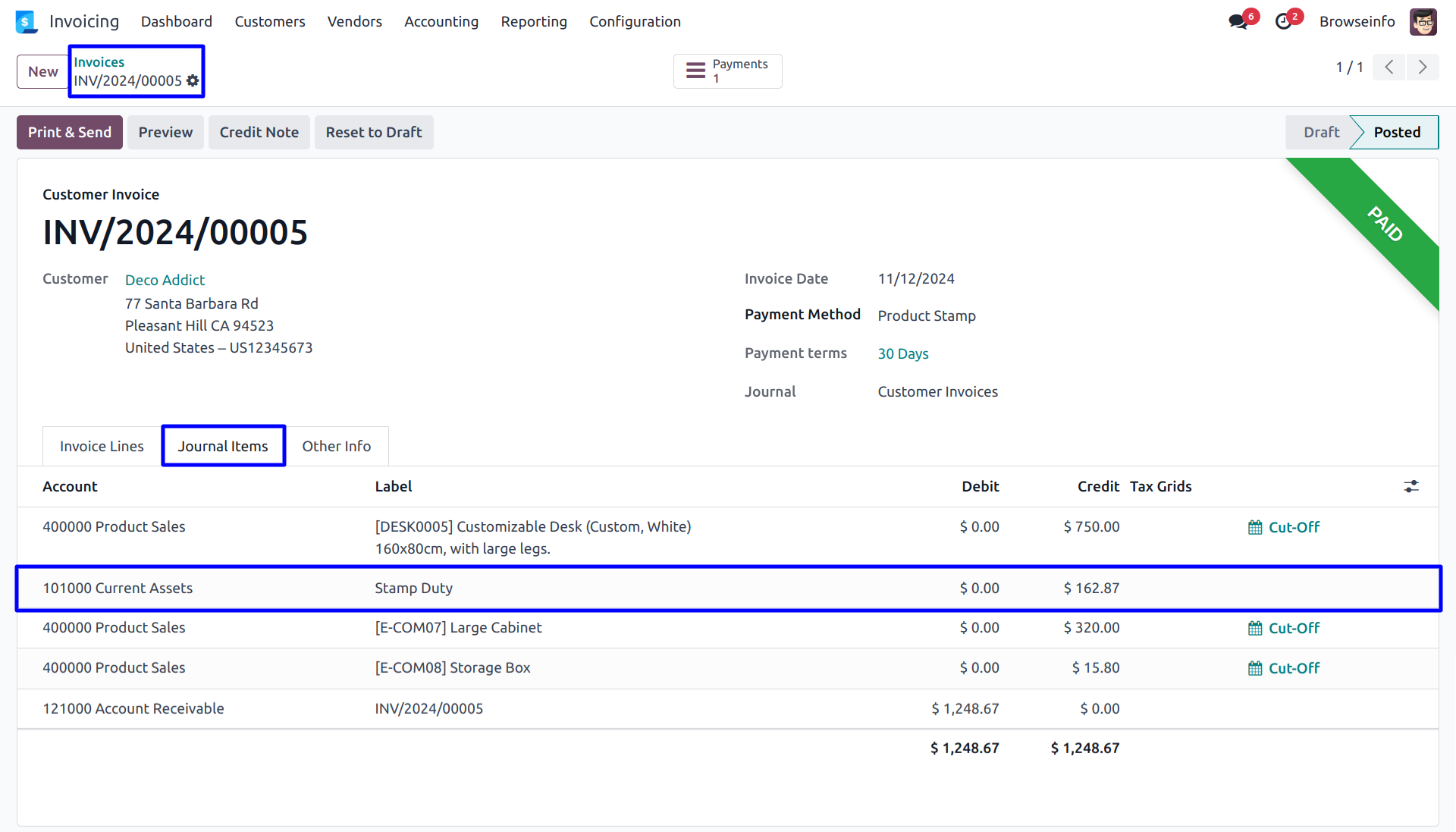

Apply Stamp Duty in Customer Invoice

When user create an invoice, They have to select the payment method and based on that stamp duty should be calculated and also included in total amount.

User can view stamp duty in journal items.

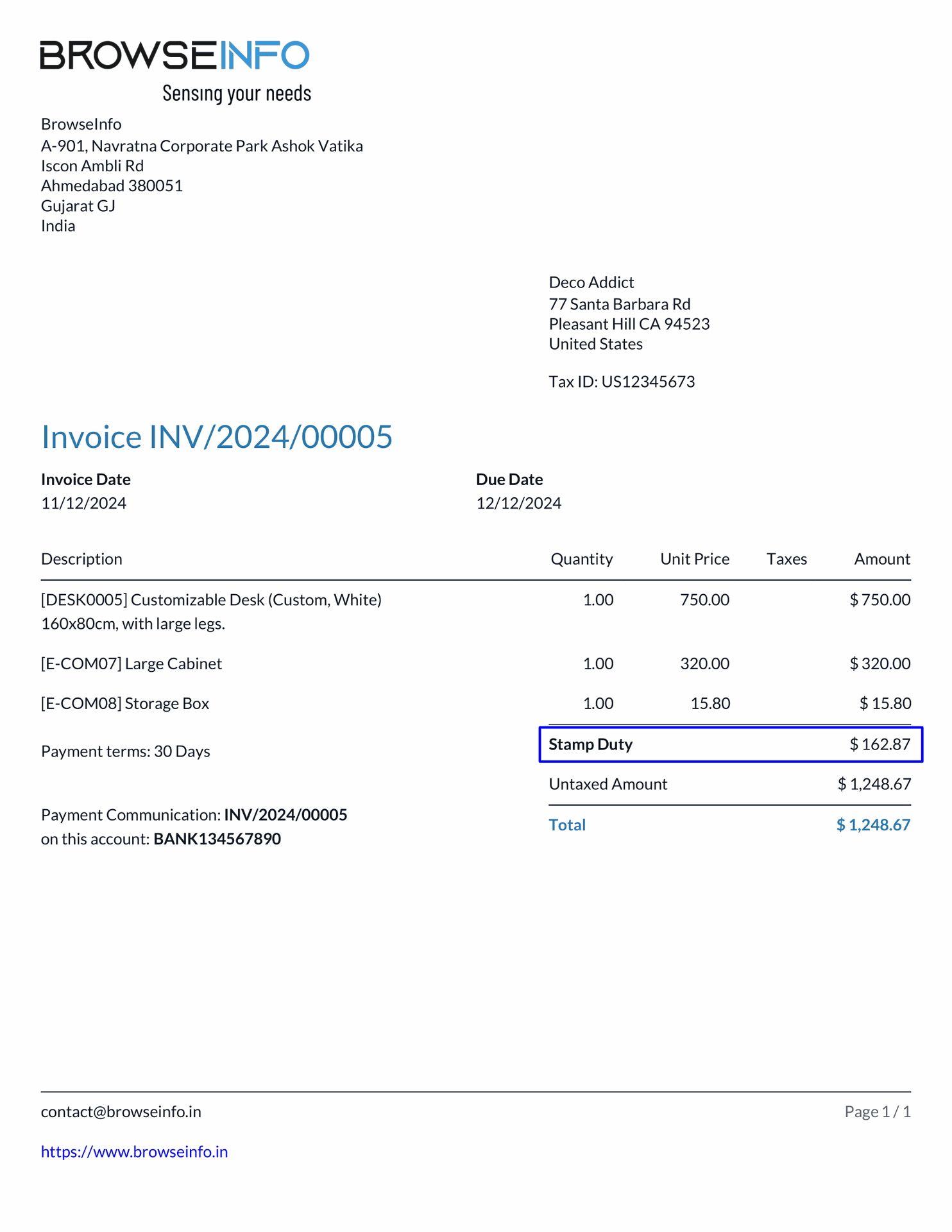

Stamp Duty in Customer Invoice Report

User can view the stamp duty in customer invoice PDF report.